- Bonds trading near or below par are much more sensitive to interest rates than reported by standard analytics systems

- Investors who rely on these systems will be in for an unpleasant surprise when rates rise

- Kalotay Analytics and Investortools, Inc. have partnered to do things right.

During recent years of historically low interest rates, with most municipal bonds trading at a premium, investors have paid little attention to the adverse effect of taxes on the prices of discount bonds. As a result, investors have neither seriously challenged, nor required Currently Used Platforms (CUPs) to provide correct interest rate risk measures for bonds trading near or below par. The reality is that CUPs grossly underestimate the effect of rising rates.

Although interest is tax-exempt, the gain resulting from purchasing a muni at a deep discount – below the so-called de minimis threshold – is subject to severe tax treatment. It is taxed as ordinary income at maturity at a rate of about 40% for the typical investor. Thus, purchasing a bond at 80 would trigger an 8-point tax liability and cost the investor 3.2% of par at maturity.

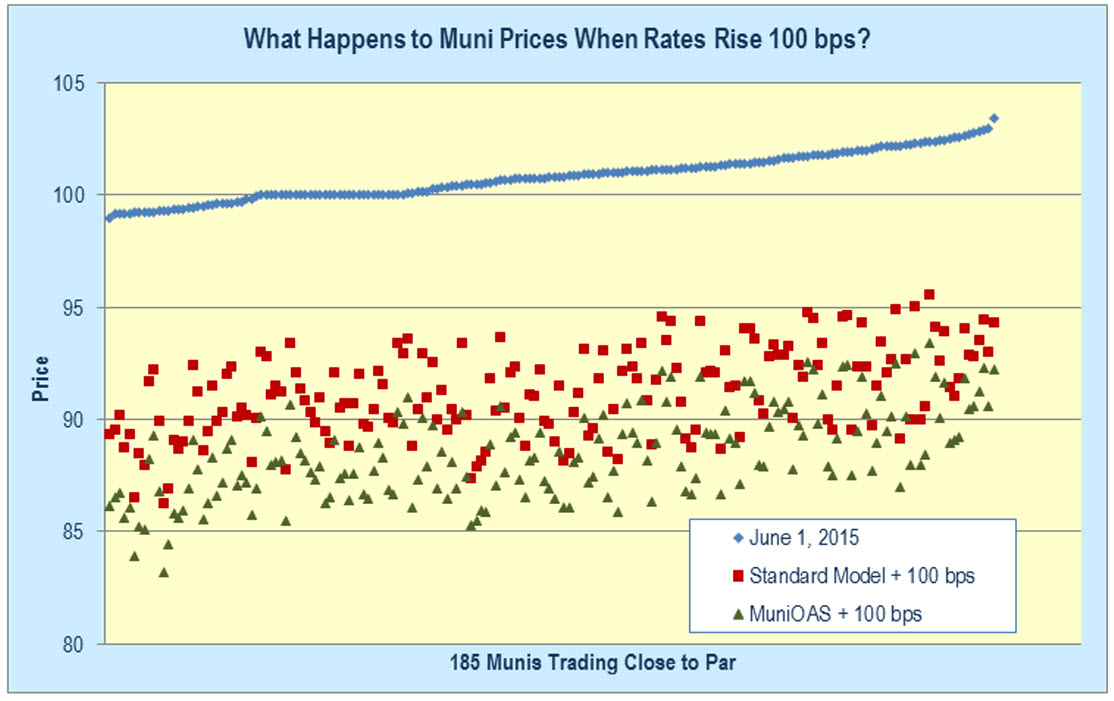

We analyzed a portfolio of 185 munis which currently trade near par (blue in the graph below). After shocking interest rates up by 100 basis points, predictably the prices fall below par. However, as calculated by CUPs, the prices (red) don’t fall far enough. They are hugely overestimated, by over 3 points in many cases. The source of the problem is that CUPs disregard the tax payable on the discount at maturity, which depresses the prices further, as correctly calculated by MuniOAS™ (green).