Fixed-Income Order Management

Experience Peak Efficiency and Unmatched Precision at Scale

Top fixed-income investment managers trust Investortools to oversee the entire trade lifecycle. From order origination to allocation and trade confirmation, our solutions empower the processing of unlimited trades across tens of thousands of accounts.

Built to Scale Your Strategy

Your strategy isn't replaced, it's amplified. Order aggregations and automatic allocations align seamlessly with your preferences and logic ensuring precision and efficiency.

Multi-Functional Platform

Investortools supports the entire order management process to bring together the front, middle, and back offices and eliminate inefficient, error-prone duplication of efforts.

Speed Without Compromise

Due to native calculations and validations, Investortools supports your data without compromising speed or data quality. This affords an information advantage that translates to fast decision-making.

Integrated Order Management

Investortools' OMS is elevated by the depth of analytics, compliance, performance measurement, indexing, and other EMS capabilities, all seamlessly managed within the platform.

Building in-house systems comes with the burden of technical debt and ongoing maintenance. We address the build-vs-buy dilemma by providing comprehensive, fully customized solutions that scale to your growth.

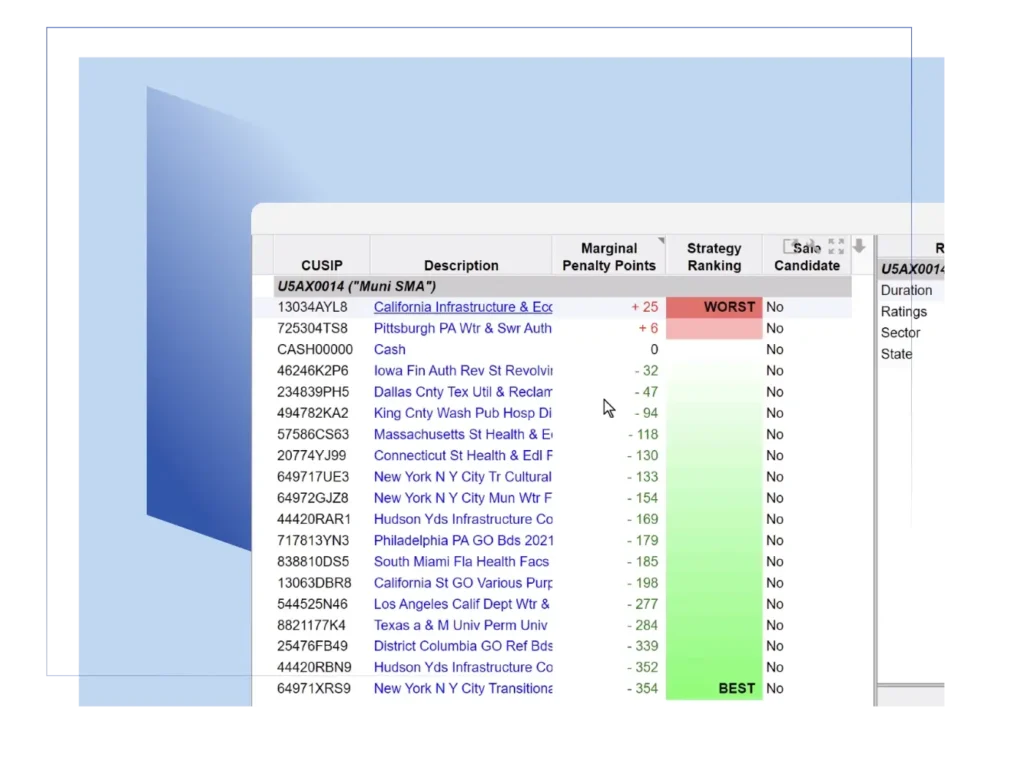

Size your orders automatically and immediately

Whether for a primary or secondary market, our platform will tell you precisely “which” and “how much” with the click of a button.

- Automatically size orders by custom ranking, including tax and risk-adjusted objective functions

- Allocate pre-trade or post-trade

- Generate characteristic-driven genericized orders as well as specific securities

Leverage real-time compliance and analytics

Prevent rule and guideline violations via always-on compliance and analytics. Investortools factors in the latest trade information, including pending activities. This feature is native and code-driven, ensuring internal consistency, timeliness, and currency.

- Ensure allocation respects warning and failure limits

- Use rules, metrics, and analytics supporting both proprietary and industry-accepted measures

- Access extensive logging that relieves the burden of proof, satisfying the most stringent internal and regulatory requirements

Increase total trade volume while decreasing trading errors

Gain the tools to trade and manage portfolios at greater scale without compromising specificity or quality.

- Achieve security sourcing, execution streamlining, and straight-through processing through electronic trading integrations

- Cast a wider net using multi-security, multi-portfolio automatic allocation

- Facilitate the handoff to the middle and back office via integrations with dealers, sponsors, and custodians

Source better bonds. Make better trades. Construct better portfolios.

Our platform’s ecosystem provides security and cash flow modeling, support for proprietary data, native credit and index data, and strategic data partnerships accelerate the transition from idea to execution.

- Leverage native modeling and analytics

- Integrate credit research

- Set active or passive targets to benchmarks

- Select third-party data providers of your preference

Streamline Secondary Market Trading into One, Centralized System

Buy and sell bonds without leaving the Investortools’ platform.