Perform

The Market’s Preferred Solution for Fixed-Income Portfolio, Order and Execution Management

Perform® is designed with the collective knowledge and experience of thousands of portfolio managers and traders, offering unmatched features that drive growth, reduce costs, and enhance performance.

Straight-through processing across the entire investment life cycle

As the premier solution for the fixed-income market, Perform empowers clients to scale their business profitably while enhancing their offerings. Our platform supports this by consolidating the management of all fixed-income aspects into a single, unified system.

Portfolio Management

Data-driven insights and advanced analytics empower you to confidently manage risk, seize opportunities, and optimize performance. Perform provides visibility and control, enabling enhanced investment strategies.

Order Management

Perform manages the entire trade lifecycle, from order origination to trade confirmation. The platform enables you to process unlimited trades across tens of thousands of accounts with ease.

Execution Management

The native EMS layer provides unparalleled interoperability, supporting powerful trading workflows, deep live-market liquidity, actionable insights, and increased efficiency.

Native Analytics

Real-time analytics unlock new offerings

Proven and powerful analytics support an extensive array of features, from amortization to z-spread. Our trusted analytic foundation underpins sophisticated option-adjusted modeling, comprehensive security modeling, total return analysis, portfolio optimization, order creation, compliance, simulated performance, and beyond.

Utilize option-adjusted modeling to better assess risk and volatility

- Choose between Hull-White or Black–Derman–Toy models

- Control model inputs, such as volatility, rate limits, and bp intervals

- Calculate OA Spread, Duration, and Convexity

- Use Key Rate Durations to better understand where duration is coming from

Model securities across the entire fixed-income spectrum

- Model nearly all fixed-income security types, including adjacent products like preferreds

- Leverage support for cash flow models, call schedules, sinking funds, multi-modals, inverse floaters, and more

- Calculate various yield metrics, including yield, taxable equivalent yield, after-tax yield to redemption, yield to worst (YTW), yield to maturity (YTM), book yield, acquisition yield, and de minimis threshold yields, among others

Leverage accounting functions for efficient tax-aware management

- Compute amortization, accretion, and book value calculations, reflecting portfolio-specific accounting settings to accurately report true income and net book worth

- Utilize adjusted tax basis and de minimis handling to determine realized and unrealized gains and losses, streamlining efficient tax-loss harvesting

- Ensure gains taxed as ordinary income are correctly reflected in all tax-relevant calculations

- Account for secondary insurance costs in all book- and tax-related calculations

Use real-time analytics vital for portfolio construction and maintenance

- Optimize risk-adjusted return for each bond bought and sold

- Receive up-to-the-minute portfolio totals and averages for precise compliance testing

- Drive allocation and portfolio scoring models with current analytic values

- Reflect cash positions with pending trades and orders

- Access pre- and post-trade impact on analytic totals at any time

Portfolio Management and Performance

Sources of portfolio performance are clearly understood

Break down returns into various contributing factors, such as interest rate movements, credit spread changes, and sector/rating allocations. Identifying drivers of performance enables more confident and informed decisions, enhanced risk management, and accountability in investment performance.

Track historical performance by component, all the way down to the individual lot level

- Report returns by user-specified component, such as duration, sector, quality, and maturity

- See the impact of weighing decisions, market movement, coupon, and rolldown

- Use scatter graphs to quickly and easily identify winners and losers

Simulate future performance to understand the impact of changing market conditions

- Create multiple scenarios to see how portfolios will react

- Choose different time horizons and curve shapes

- Specify varying spread adjustments based on sector, rating, or custom factors

- Weight the probability of each scenario to calculate composite expected return

Integrate performance, both historical and simulated, into user reports

- Tell your story by including return in standard and client facing reports

- Use simulated performance to inform buying and selling decisions

- Easily compare portfolios and strategies to each other

Order Management

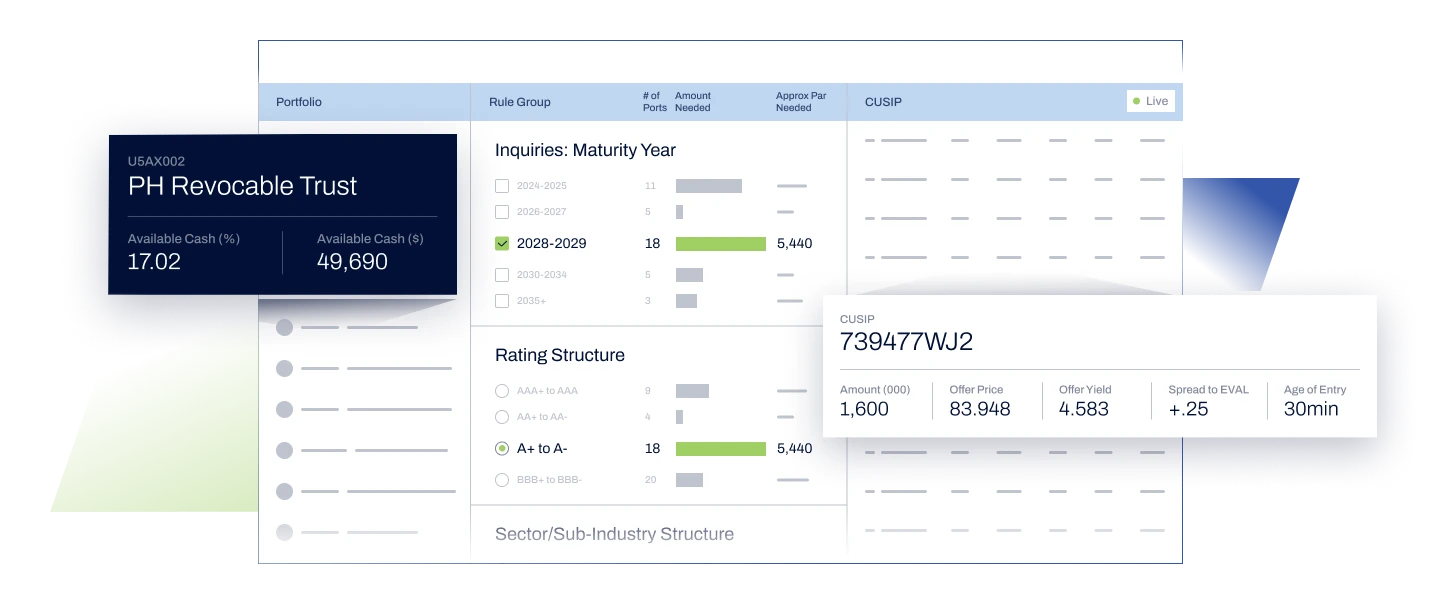

Automation streamlines orders, prevents violations, and identifies better bonds

Perform’s OMS features are indispensable to managing a successful SMA business. Its many functions work together to enable clients to run a low-touch business while providing high-touch results.

Automate the construction and maintenance of portfolios to reflect your unique investment approach

- Base allocation models on portfolio manager convictions and user-defined logic

- Evaluate and place the best bonds into the right portfolios with order aggregations and auto-allocations

- Use multi-factor portfolio optimization to inform buying and selling decisions

- Leverage market-driven data insights to strategically deploy risk

- Automatically build portfolios to maximize risk-adjusted returns

Enable restrictions, PM convictions, and client customizations to work seamlessly with always-on compliance

- Set rules to limit what bonds a portfolio can hold

- Define targets to successfully embody strategies

- Evaluate multiple bonds, strategies, and accounts simultaneously with each trade

Simplify cash raising and tax-loss harvesting

- Utilize analytics for up-to-date prioritization of holdings

- Apply user-specific models to identify the best sale candidates and track progress toward goals

- Leverage live market connections to satisfy cross-trading requirements

Execution Management

Efficient trade workflows boost trade volume

Gain comprehensive visibility into the live market with a consolidated view of liquidity and real-time pricing data. Our solution integrates seamlessly with OMS features to ensure best execution, minimize operational risk through automated processes, and uncover superior investment opportunities.

Aggregate live market seamlessly

- Utilize disclosed, bilateral trading connectivity with dealers to recieve direct offers and BWICs

- Ensure full market awareness and all-to-all trading capabilities through ATS connectivity

- Rely on real-time pricing and pre-trade market data to inform and confirm your decisions

- Expand your reach for RFQs with broad market connectivity

Enhance investment performance with OMS integration

- Pre-allocate bonds to ensure optimal fit in portfolios

- Aggregate inquiries across portfolios to receive round lot pricing

- Leverage OMS to scour live offers and suggest bonds that best fit your needs

Ensure best execution

- Improve and leverage trading relationships through direct connections

- Maximize efficiency with automation, accessing the deepest bid stack possible

- Access integrated pre-trade analytics from multiple sources

Minimize operational risk

- Eliminate error-prone copy/pasting between systems

- Gain a comprehensive market view to find the best bonds at the best price

- Enhance speed to capture fleeting opportunities

Unprecedented Connectivity, Extensive Integrations

Empower your trading strategy with the Investortools Dealer Network, where direct dealer connections, robust ATS integration, and industry-leading automation seamlessly integrate with your proprietary trading styles, delivering unparalleled efficiency and control in every trade.

Perform

Portfolio Management

- Rules

- Holdings

- Strategies

Order Management

- Inquiries

- Pre-Trade Compliance

- Auto-Allocation

- Custodial Allocations

Execution

- Click to Trade

- Bid-Back

- Market Data

Credit Research

- CUSIP to Credit Link

- Analyst Opinions

- Internal Ratings

Investortools Dealer Network

Direct connections to dealers and ATS support live streaming of offers and BWIC. Allows click-to-trade, click-to-bid, and RFQ in Perform.

Investortools FIX Integrations

Real-time, persistent FIX connections for the straight-through processing of execution details and custodial allocations.

Bond Dealers

Alternative Trading Systems

Perform® FSD

Perform for Securities Dealers

With more than 6,000 portfolios, a powerful search engine, and comprehensive trade details, Perform FSD is the must-have system that offers transformative possibilities for your sales and trading desk.

- Fixed-income portfolio database of buy-side bond holdings

- Quickly identify trade opportunities

- Track changes, spot trends

Smart™

Short Maturity Portfolio Management and Compliance System

The front-office toolkit for institutions seeking to scale their short-duration investment business.

- Scale your business

- 2a-7 and internal policy compliance

- Manage risk with stress testing

Experience the Fixed-Income Solution Preferred by Industry Leaders

See how Perform can drive growth and profitability for your fixed-income business.