Separately Managed Accounts

Moving the Fixed-Income Market From High-Touch to Low-Touch

The majority of fixed-income SMA managers depend on Investortools, with the platform handling over 300,000 SMAs with assets exceeding $400 billion. The key to clients’ success: a single, integrated, and scalable solution that simplifies complexities and accelerates growth.

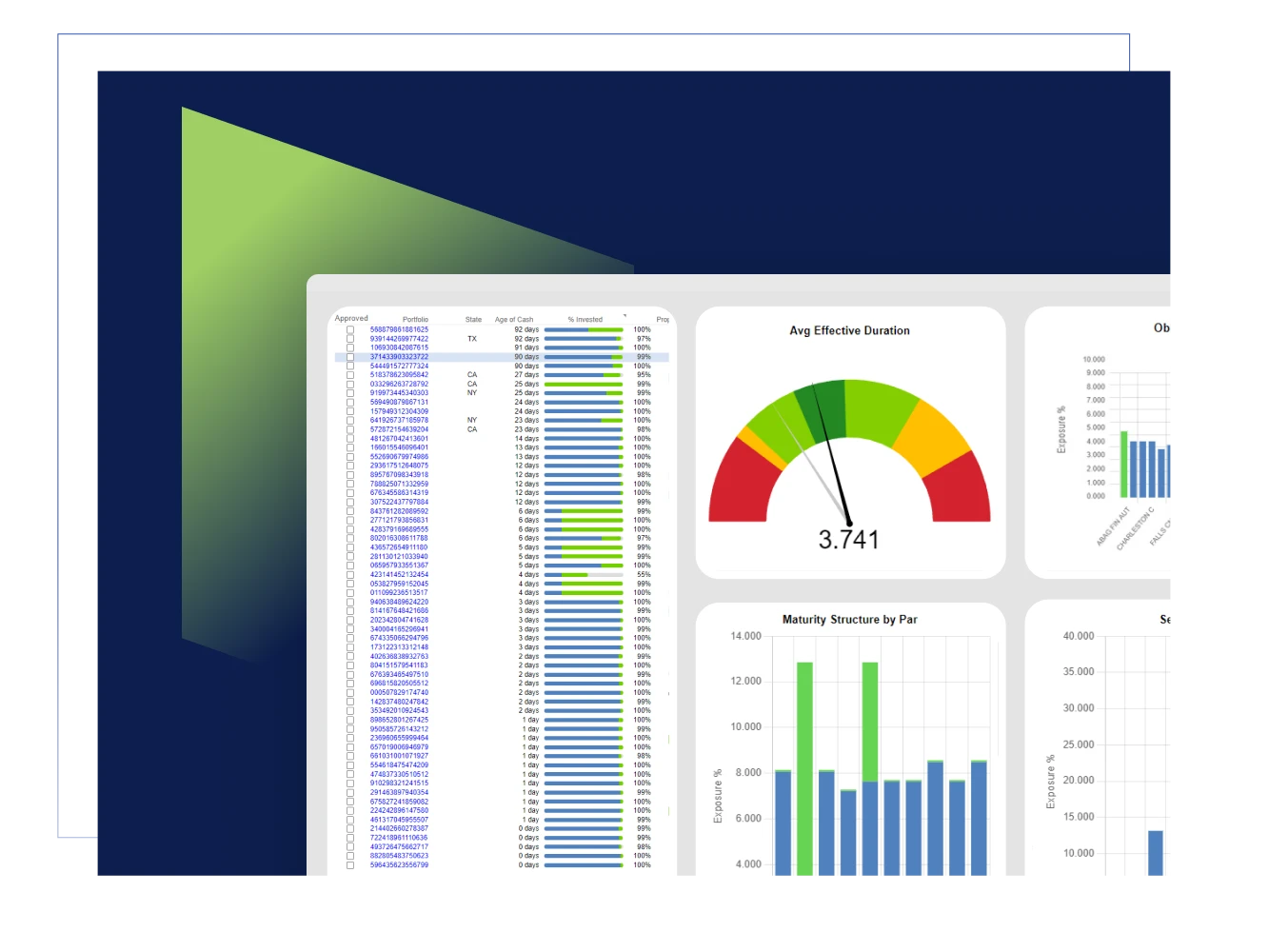

Portfolio Management

The foundational solution for managing SMAs that automates manual processes, optimizes bond allocations, and manages a book of client portfolios.

Order Management

A deep bench of integrated solutions power management of the entire trade lifecycle, aggregating orders and inquiries to optimize SMAs.

Execution Management

Live liquidity and BWICs aggregated from ATS and direct dealer connectivity drive optimization of trading opportunities.

Always-On Compliance

Active compliance enables adherence to compliance mandate restrictions, portfolio manager convictions, and client customizations.

Credit Research and Analysis

An extensive library of sector-based credit data, tools, and models enable data analysis and expedite credit decisions to achieve higher total returns.

High-touch approaches constrain scalability. Rapid AUM growth, shrinking account sizes, fee compression, and a fragmented market all challenge profitability. The solution lies in adopting an automated, low-touch approach, with Investortools as the best-in-class choice.

Low-touch portfolio construction

Strategies that unify portfolio manager convictions and portfolio guidelines speed the task of finding the right bonds for each account.

- Fully invest accounts in days, not weeks, boosting returns

- Construct portfolios with consistent standards to minimize dispersion within a strategy

- Incease accounts under management at less cost

Low-touch portfolio maintenance

Drastically reduce the time and energy required to keep accounts aligned with their strategy.

- Aggregate your accounts' needs with inquiries that direct you to the right bonds in the right amounts

- Eliminate worry about the IPS with our always-on compliance

- Streamline the complex task of tax-loss harvesting with powerful cash-raising and tax-loss harvesting tools

- Integrate credit research workflows to reduce risk

Low-touch trading: A force multiplier

The platform offers the largest, consolidated view of the live, secondary market for discovery and electronic trading.

- Leverage direct connections to dealers and ATSs to bring the market into your OMS

- Evaluate the market to identify trades that quickly build portfolios and positions

- Maximize participation in the secondary market to boost velocity and harvest alpha

Low-touch compliance and operations

Middle and back office operations are streamlined and automated, reducing errors and manual processes.

- Ensure seamless compliance with always-on monitoring, eliminating time-consuming testing and exception handling

- Enable ultra low-touch operations with direct connections to dealers, ATS platforms, and clearing services

- Simplify operations with custodians and counterparties through streamlined allocations at the omnibus and sub-accounting levels

Streamline Secondary Market Trading into One, Centralized System

Buy and sell bonds without leaving the Investortools’ platform.

Investortools Products

Meet the innovative product technology that powers our portfolio management system

Move From High-Touch to Low-Touch to Profitably Scale Your SMA Business

See why Perform’s robust suite of features are used by the majority of fixed-income SMA shops to scale their business and provide their clients with superior performance.